Companies

If data defines society, how should blockchain redefine data?

By Kristen Nicole

SiliconANGLE

February 20, 2018 — Santa Cruz, CA

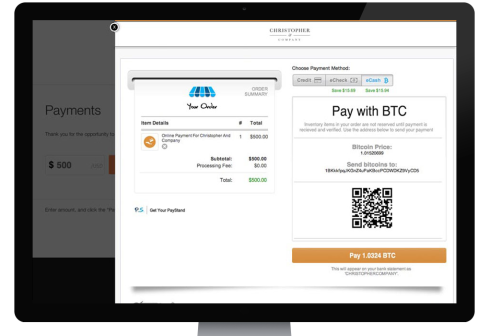

PayStand combines blockchain tech with software services to digitize the paper check and automate a hefty chunk of the accounting department’s manual work.

Jeremy Almond is the founder and CEO of PayStand, a four year old startup in Scotts Valley. (Source: LinkedIn)

From voting data to land ownership, the manner in which records are kept affects the whole of society. In today’s ad-driven economy, much of that data is held in corporate servers, and society is questioning the overseers.

Look no further than the recent Equifax breach for justification of societal concern. Such intrusions on centralized databases beg the question of responsible data-storing practices, forcing regulations like the European Union’s right to be forgotten act — the General Data Protection Regulation — and spurring new technologies, like the blockchain, to rebuild society’s trust.

“Companies are fallible, and so what blockchain does is it allows us to make a more infallible system to keep access to those records you and I care about,” said Jeremy Almond (pictured), founder and chief executive officer of PayStand Inc. During a visit to theCUBE’s studio in Palo Alto, California, home of SiliconANGLE Media, spoke with theCUBE host John Furrier (@furrier) about the larger role of blockchain in modern society and how the technology has impacted both enterprise infrastructure and business models.

Digitizing responsibility

Claiming to be the first payments-as-a-service provider, PayStand combines blockchain tech with software services to digitize the paper check and automate a hefty chunk of the accounting department’s manual work. The four-year-old startup sees blockchain as a tool to revolutionize monetary exchanges between businesses, contextualizing transactions with additional data points for speedier verification of identities and accounts.

“You and I, we Venmo each other,” said Almond, likening Paystand’s business-to-business payments to Venmo’s consumer-to-consumer process. “But when the business goes to write a check, when they get an invoice, they send out a check. And so we digitized the whole process — the moment that the invoice is ready to go to the moment it gets in the bank.”

Continue reading article here: https://siliconangle.com/blog/2018/02/12/data-defines-society-blockchain-redefine-data-thecube-cubeconversations/

###

Tagged Jeremy Almond, PayStand